Carmichael International manages customs brokerage services for a top U.S. importer. An analysis of the customers imports found that they were paying higher duties and taxes by not correctly valuating their imports. They were able to significantly reduce costs by improving this process.

Customer Overview

- Company: North America’s leading retailer of personalized merchandise and experiences

- Vertical: Retail

- Services: Complete Customs Brokerage services by Carmichael International Service for shipments arriving in the U.S

- Volume: Approximately 300 entries on an annual basis

Challenges

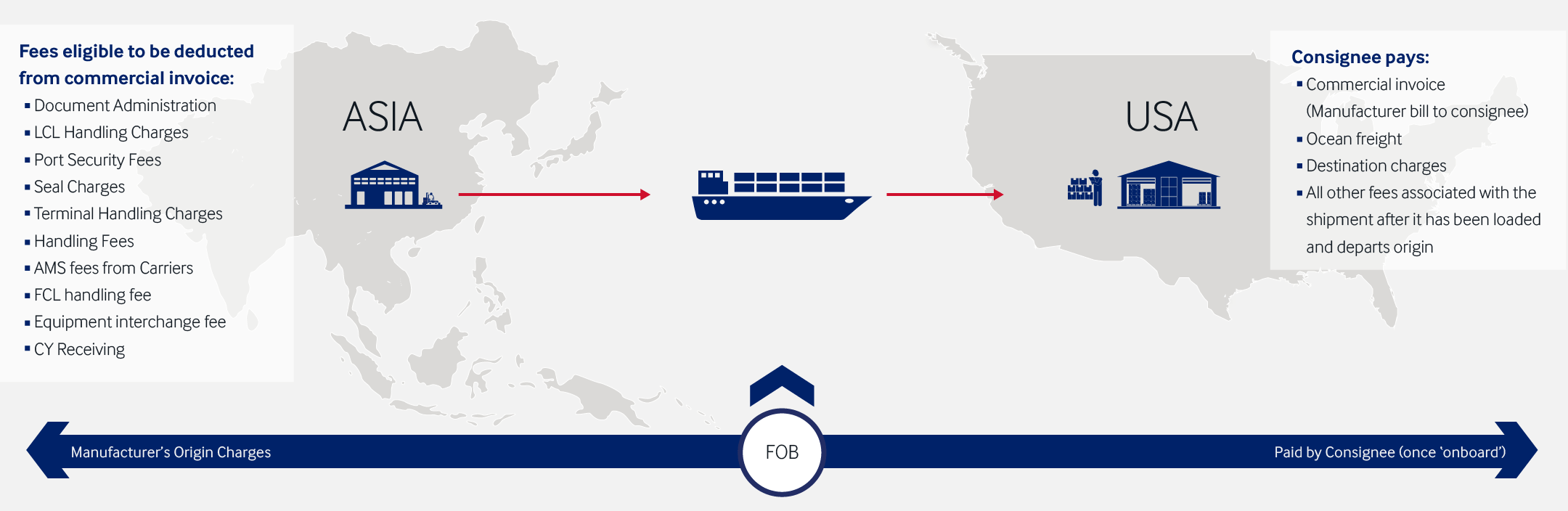

- Customer was paying duty on fees not related to the actual manufacturing of the product

- How to identify the origins fees eligible to be deducted from the commercial invoice

- Once eligible fees are identified how they can be deducted from the commercial invoice

Apl Logistics Solutions

- All fees eligible for deduction are listed on the APL Logistics’ FCR (Forwarders Cargo Receipt) for the Vendor (Manufacturer) to determine accounts payable charges

- APL Logistics forwards the FCR to Carmichael

- Carmichael deducts all the charges listed on the FCR from the corresponding commercial invoice

Benefits

- This solution has reduced, on average, the duty paid per entry by $55

- Using the FCR as the controlling document also simplifies the tracking of deductions in the event of an audit by Customs